Paytm tests AI-powered POS device for merchant performance insights

Merchants in India tested the tool, often using it for real-time translation.

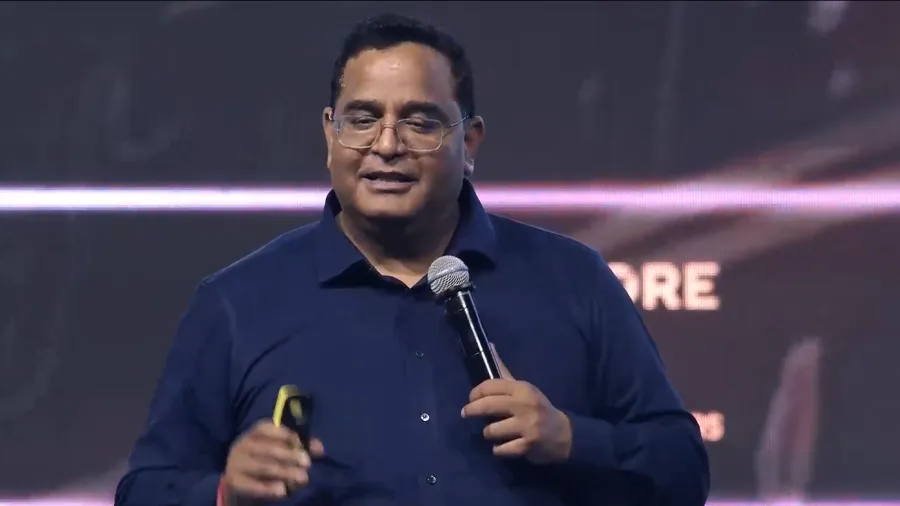

A point-of-sale (POS) device with a built-in artificial intelligence (AI) model that allows merchants to ask how their business is performing—such as how much they made in a given week or month—is being tested by Paytm, said Founder and CEO Vijay Shekhar Sharma.

Speaking during his keynote address at the Singapore FinTech Festival 2025 on 14 November, Sharma said the device is capable of answering operational questions using data generated from merchants’ transactions. “It becomes a Chief Operating Officer, Chief Marketing Officer, Chief Finance Officer.”

The device’s pilot in India revealed that merchants often used the device for real-time translation during negotiations.

“A merchant would say, “Can you speak to this customer in English and tell them this is the best rate I can do— 25,000, give or take?” he added.

Sharma added that the payments ecosystem has reached a point where data generated through smartphones, POS devices, and supply-chain systems can now support broader automation beyond credit.

For instance, specific insights could eventually help small retailers automate stock replenishment in the same way large chains use analytics for inventory planning. “If you are a grocery store and milk is selling quickly for various reasons, an automatic supply is now arranged to meet the demand.”

Sharma said the growing use of such tools reflects how AI will increasingly factor into financial institutions’ risk functions, noting that automation could change how firms handle routine risk tasks. “Most of the journey will become automatic, yet at that point, both the regulator and the organisation will have an appointed human in place.”

“There is an intelligence beyond humans — It remembers, it learns, it evolves,” he said. “This will require our regulators to embrace this technology, because it fulfils their intent to lower costs and expand access to the financial system.”

Sharma linked this shift to the widespread use of mobile payments, which has created new data on daily business activity, citing that Paytm now supports 44 million merchants in India, enabling lenders to assess firms that often lack formal credit histories.

“Payments generate data, and data generate underwriting knowledge,” Sharma said.

Such data trails make it possible to evaluate working-capital needs based on “future forward receivables,” offering credit to merchants whose cash flow can be verified through digital transactions. “

“Businesses do not need assets—they need to be diligent in receiving digital payments. If you receive digital payments and have enough history, we can underwrite your future receivables,” he added.

Furthermore, the broader adoption of AI will push financial institutions to rethink how they assess, price and monitor risk across both small and large enterprises.

AI-driven systems will allow institutions to underwrite smaller borrowers in the same way they evaluate larger, more established firms, Sharma said.

However, while larger firms can adopt advanced technology, smaller businesses may struggle to keep pace, and those unable to adapt risk falling completely out of the business economy.

“It is easy for big players to get big money; the small players don’t get small money,” Sharma said. “That can only be done when we can capture insights and data.”

Advertise

Advertise