Lending & Credit

CBA credit losses seen steady as debt risks linger: S&P

CBA credit losses seen steady as debt risks linger: S&P

The bank is vulnerable to housing-related risks.

4 days ago

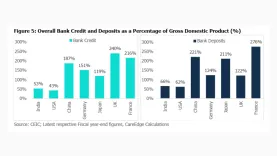

How India’s 53% credit-to-GDP ratio exposes a lending gap

Formal borrowing is expanding but still trails the scale of domestic economic activity.

5 days ago

Why Asia's banks are rebuilding their credit infrastructure in 2026

Customers now expect visibility alongside instant credit experiences.

5 days ago

How can Indian lenders balance loan growth and risk?

Reforms could help improve efficiency, especially of state banks.

6 days ago

Taiwan SME loans jump $17.38b in 2025 as banks hit 120% target

SME loans made up 64.81% of total loans extended to all enterprises.

6 days ago

Big borrower default could wipe out a year of SEA bank earnings: S&P

Brunei, the Philippines, and Thailand are the most exposed to loan concertation risk.

Indian bank credit jumps 14.4% in December as gold loans double

Power segment and ports drive infrastructure credit growth.

Westpac hikes home loan rates as it flags budget pressure

Westpac's consumer chief executive recognized that the increase may add pressure to households.

Norinchukin fortifies JA Mitsui Leasing after $968m fraud allowance

Norinchukin is in talks with SMBC and other major banks to provide loans to JAML.

SMBC signs SBI pact to back India sunrise sector project finance

They aim to grow India’s “sunrise sectors”.

Vietnam banks face whiplash as fast lending fuels asset price risks

Credit growth target is 15% in 2026, but banks can be hurt if prices correct.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

The region is amongst the fastest-growing private credit markets globally, albeit from a smaller base.

Philippine banks signal credit squeeze as tightening bias grows in Q1

About 12.8% of banks expect to tighten credit standards for household loans.

Taiwan bank loan growth to hit high single digits on US pact

Increased overseas investments and corporate credit demand will lift loas.

Greater Bay Area loan access index sinks to 48.7 as recovery reverses

Quarterly business confidence data shows lending conditions falling back into contractionary territory.

South Korean bank delinquencies hit 0.6% with SMEs hit hardest

Volume of newly delinquent loans shrank whilst resolved loans rose.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership