In Focus

How will mergers and crypto regulation reshape APAC fintech investment in H1?

How will mergers and crypto regulation reshape APAC fintech investment in H1?

Chinese fintechs will embrace "dual-market routes" to grow overseas.

12 hours ago

APAC fintech deals drop to $9.3b in 2025 as private equity hits record low

Venture capital investment for fintechs in the region also fell to its lowest in a decade.

12 hours ago

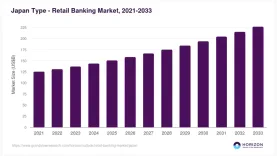

Japan retail banking to hit $227b by 2033

Market revenue stood at $143.7b in 2024 with 5.2% annual growth projected.

13 hours ago

Indonesia’s Islamic loans to grow 10% but banks capped at 8% market share

Bank Syariah Indonesia (Persero) is likely to remain dominant.

1 day ago

Singapore card payments hit $119.6b in 2025 on SME push and contactless cards

Credit and charge cards made up two-thirds of the value.

1 day ago

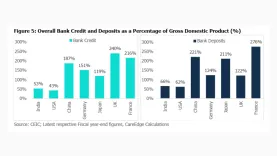

How India’s 53% credit-to-GDP ratio exposes a lending gap

Formal borrowing is expanding but still trails the scale of domestic economic activity.

1 day ago

Vietnam banks face credit split as quota phaseout looms and Basel III rolls out

Weaker, capital-constrained banks may struggle to meet regulatory changes.

2 days ago

Malaysia payments flip non-cash as e-wallet usage jumps 14%

Online bank transfers also gained whilst debit and credit cards ranked last amongst users.

2 days ago

How can Indian lenders balance loan growth and risk?

Reforms could help improve efficiency, especially of state banks.

3 days ago

Big borrower default could wipe out a year of SEA bank earnings: S&P

Brunei, the Philippines, and Thailand are the most exposed to loan concertation risk.

3 days ago

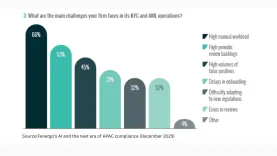

Half of APAC banks hit KYC backlog as manual systems fail

In Singapore, nine institutions were fined a combined $21m for anti-money laundering failures.

3 days ago

Indonesia loan demand stagnates as MSME and consumption slumps

Underlying demand for loans remains uneven although liquidity will be abundant, analyst said.

6 days ago

Digital payments clock 13% growth as physical cards retreat

Super-apps reduce dependency on traditional products by bundling diverse financial tools.

6 days ago

India's public banks must cut branches to hit 'world-leading' goal: S&P

Indian PSBs are inefficient due to underutilised and low-yielding branches, an analyst said.

Only 1 in 10 banks see AI returns despite $97b spend by 2027

Data fragmentation and governance uncertainty plague most AI adoptions.

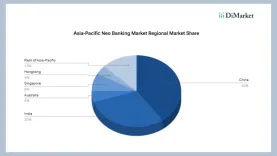

APAC neobanking hits $261b in 2025 as mobile use rises

China and India account for 70% of regional market share.

Payroll drives rural Indonesia banking uptake as digital banks fail to sway users

Digital banks are known but users said there is no difference in app experience.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership