In Focus

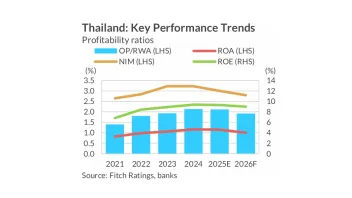

Thai banks brace for weaker 2026 earnings as rate cuts hit margins

Thai banks brace for weaker 2026 earnings as rate cuts hit margins

Loan growth may pick-up but likely to stay in single digits, says Fitch.

Banks struggle to keep pace as fintechs scale agentic AI

Most incumbent initiatives are defined by narrower applications.

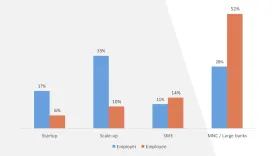

Singapore’s fintechs see mismatch between talent and hiring demand

Startups and scale-ups are the biggest employers whilst talent comes from MNCs.

Indian banks’ profits to soften in 2026 despite improved credit costs

Authorities' measures to boost consumption and investment will sustain revenues.

APAC DM banks take on more risk as margins shrink

Aussie banks are growing their SME exposure whilst other banks are expanding overseas.

CIMB's new card gives 114-day interest-free drawdowns to small businesses

It offers 114 days interest-free period for working capital loans.

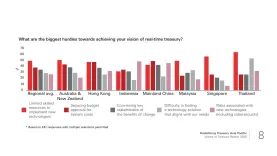

What do corporate treasuries need from banks today?

The majority want a simple, real-time dashboard but may not have the budget or skills.

Hong Kong’s banks pressured by real estate stress and lower margins in 2026

Many banks have begun cutting property exposure.

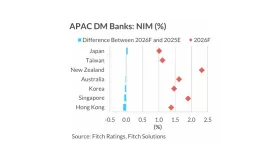

APAC developing markets slated to see lower margins in 2026

Except for Japanese banks, which could see NIMs rise faster if monetary tightening is more aggressive than expected.

Mortgage competition between Aussie homeowners and investors heats up

First-time homeowners increasingly need to take on more debt to afford a house.

Japanese megabanks see profit rise, but capital remains a weakness

Overseas expansion is another risk, as it could raise credit costs, warned Fitch.

Which suburb in Australia leads in mortgage arrears?

Victoria and New South Wales are the only states represented in the highest-arrears list.

China, Taiwan, Hong Kong, Thailand banks face weaker 2026 outlook

Japan is the only banking market in APAC to hold an "improving outlook," according to Fitch Ratings.

Banks a key entry point for Web3 adoption

Over 8 in 10 will use or will strongly consider using Web3 services if offered by a bank.

Why SMBC launched an agentic AI startup in Singapore

Account opening may drop to two days and loan processing to five.

DANA eyes wider ASEAN reach with cross-border payment push

It is broadening merchant acceptance both online and at physical points of sale.

Weak household demand causes 82.9% drop in new Chinese bank loans

This was blamed on weak household loan demand, particularly short-term loans.

Advertise

Advertise

Commentary

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership