Retail Banking

ANZ logs $1.38b profit in Q1 2026 on higher deposits and improved costs

ANZ logs $1.38b profit in Q1 2026 on higher deposits and improved costs

The bank’s productivity program is underway, said CEO Nuno Matos.

1 day ago

Hong Leong Bank rebrands wealth segment as HLB Priority and revamps centres

Modernisation of priority centres is scheduled to be completed around March 2026.

1 day ago

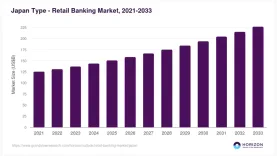

Japan retail banking to hit $227b by 2033

Market revenue stood at $143.7b in 2024 with 5.2% annual growth projected.

1 day ago

OCBC enables Weixin Pay QR payments via bank app

Customers will see rates in real-time before making a transaction.

2 days ago

HSBC Singapore names Suzy White to its board

White is the current group COO of HSBC.

2 days ago

CBA earnings up 1% YoY to A$718m in H1 as deposit margins fall

Customer margins remained flat during the period.

2 days ago

Asia’s banks hold the mandate to innovate. Now they must earn it.

Banking is no longer measured against other financial institutions, but against digital experiences.

3 days ago

NAB offers everyday banking appointments via Zoom call

Customers can self-book appointments at the NAB website starting March.

3 days ago

Westpac rolls out Copilot to 35,000 global staff

Its teams have already built several AI agents for HR and IT.

3 days ago

SBI hits record net profit of $2.32b in Q3 FY2026

Operating profit rose almost 40% although NIM fell to 3.12%.

3 days ago

Philippine bank lending hits 9.2% in December

Loans to non-residents declined faster than the previous month, however.

3 days ago

Vietnam banks face credit split as quota phaseout looms and Basel III rolls out

Weaker, capital-constrained banks may struggle to meet regulatory changes.

3 days ago

How can Indian lenders balance loan growth and risk?

Reforms could help improve efficiency, especially of state banks.

4 days ago

Korean banks see Q4 net incomes halved on costs and FX losses

Loan growth will remain challenging in FY2026, CreditSights said.

4 days ago

Norinchukin Bank to accept $36.37m capital subscription

Nochu recently announced plans to support affiliate JA Mitsui Leasing.

4 days ago

SCB expands cardless withdrawals to 9,200 ATMs with new partners

SCB first introduced cardless ATM withdrawal services in 2021.

4 days ago

Taiwan bank loans hit $1.43t in Dec 2025 as bad debts drop

Coverage allowance for NPLs rose to 917.43%.

4 days ago

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership