Retail Banking

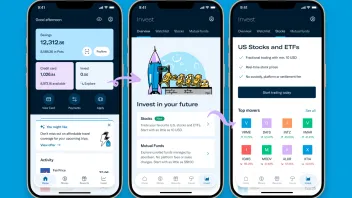

Trust is first banking app in Singapore to offer fractional trading

Trust is first banking app in Singapore to offer fractional trading

It now gives access to over 7,000 US stocks and ETFs.

SMBC to transform India branches into subsidiary after conditional RBI nod

The Japanese megabank will transform its local presence into a centralised corporate structure.

India's Canara Bank enables UPI payments on ai1Pe app

Canara Bank now has access to the latest UPI functions and updates.

ICICI profit slips as provisions more than double in Q3 2026

The bank had to make a $143m for regulatory compliance related to agri loans.

HDFC Bank enables digital rupee payments for merchants

SmartGateway merchants can now accept CBDC or digital rupee payments.

PH central bank warns public against scammers posing as employees

The BSP will never ask the public to transfer funds from their accounts, it said.

BOCHK capitalisation strong but property risks remain

Fee income and treasury income will support its profitability through mid-2027.

4 APAC markets face 'declining' outlook as loan yields retreat: Fitch

Any resulting drag on the operating profit and RWA should be manageable.

Korean banks’ loans contracted in December as banks guarded capital ratios

SME loans fell as banks slowed down lending for their capital adequacy ratios.

Weekly Global News Wrap: Trump floats 10% card rate cap; Citi to cut 1,000 jobs

And Credit Agricole wins ECB approval to lift Banco BPM stake above 20%.

Taiwanese domestic banks’ SME loans rise to $341.94b in November

Loans extended to SMEs by domestic banks account for 64.7% of total loans.

BSP extension lets banks write bigger green loans beyond 25% cap

Banks can exceed the single borrower’s limit by an additional 15%.

Southeast Asia fintech funding fell 21% in 2025

This is despite Airwallex and Superbank doing well in their fund raising and IPO.

Thailand’s Krungsri names new two new senior executives

Duangdao Wongpanitkrit and Hiroshi Kurihara took over their new roles last 1 January.

Australia’s big four banks loan deferrals, waive fees for bushfire victims

NAB is providing A$1,000 grants and additional financial relief, for example.

Indian banks set to benefit from tighter oversight in 2026

The RBI’s multiple reforms over the next year will allow banks to provision more effectively.

PAObank offers 1% savings boost via Money Safe

Customers can activate the safety feature that protects their deposits until 31 March 2026.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026