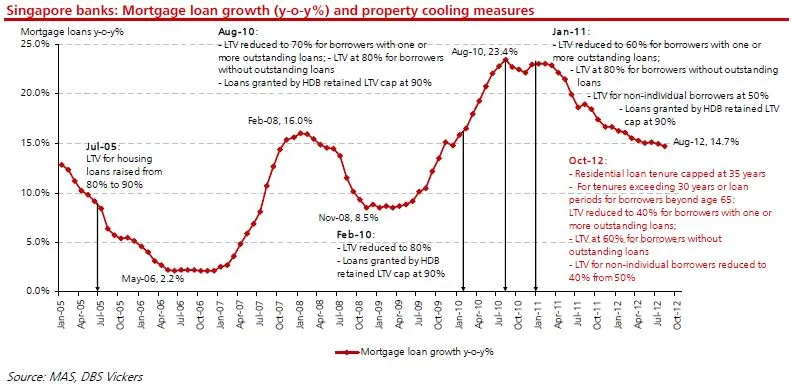

Singapore banks' mortgage loan growth to slow in 2012

You can blame the meager 10% growth expectation on the new property cooling measures.

According to DBS Vickers, mortgage loan growth will continue to slow and mortgage loan growth is expected to gradually moderate for the rest of the year but supported by drawdown from previous mortgage applications. The firm forecasts mortgage loans to grow at 10% for 2012.

"FY13-14F mortgage loan growth would likely reduce further as impact of the new measures kick in. As at 2Q12, DBS, OCBC and UOB’s mortgage to total loans stood at 21%, 25% and 29% respectively. Each grew mortgage loans by 9%, 21% and 17% y-o-y respectively as at end 2Q12."

Click the image to enlarge.

Advertise

Advertise