CBDC for cross-border settlements

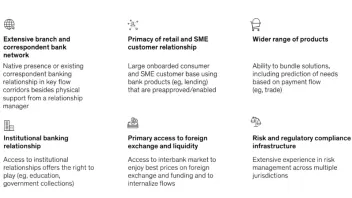

How Asian banks can retain their cross-border dominance

How Asian banks can retain their cross-border dominance

The emergence of fintechs is whittling down their dominance.

Wider use of CBDCs for cross-border settlements dents banks’ fee income

Lenders will have to reduce cross-border fees once CBDCs become more mainstream.

Join the community

Thought Leadership Centre

Most Read

1. 2 in 3 Singaporean retail investors now hold crypto: survey 2. Singapore vital in Southeast Asia’s digital economy: report 3. Hang Seng revamps branches, opens wealth centre at Kowloon main branch 4. Asia risks succession crisis as wealth surges ahead of planning 5. AMINA HK can now offer crypto spot trading, asset safeguardingResource Center

Awards

Jul

02

Events

Event News

Asian Banking & Finance Retail Banking Awards 2025 Winner: Carlo Mariano and Ivy Uy of East West Banking Corporation

Carlo Mariano of East West Banking Corporation shares how EWBC’s regulatory solution ensures compliance while putting customers first.

Advertise

Advertise

Commentary

Fighting fraud in the digital banking age

Asian banking’s next frontier: Beyond growth, embracing precision

Rethinking cybersecurity: How APAC banks can safeguard against AI-powered threats

Why Singapore’s fast payments need faster protections