Lending & Credit

Embattled Vietnamese banks take refuge in foreign investments

Embattled Vietnamese banks take refuge in foreign investments

Japan-based J Trust Corp will buy a stake in Construction Bank for an undisclosed amount.

India could impose bad debt resolution rules on state banks: report

Lenders are hit with a total bad debt of $146b.

Chinese megabanks caution against bad loans as year-end profits take hit

Lenders also sharply increased provisions for future bad debt.

Australian banks blame tighter credit checks for home loan decline

Applications dwindled despite unchanged loan success rate.

Indonesian banks' bad loan ratio down to 2.4% in 2018

The decline comes in spite of recent domestic rate hikes.

Vietnam drafts rules urging lenders to settle bad loans before dividend payouts

The rules will apply to credit institutions and not to state-owned commercial banks.

Delayed accounting rules bring reprieve to debt-ridden Indian banks

State banks would have to raise $16b in provisions in Q1 if the rules kicked into effect.

Soured debt outpaces growth of Philippine bank loans in 2018

Bad loans grew 16.17% even as total loans rose 13.6%.

Indonesia's 88 fintech lenders see opportunity in US$70b credit gap

With average loan sizes of US$35,000-200,000, farming remains the main opportunity.

Deutsche Bank establishes bad-loan buying unit in India

More than 29 asset reconstruction companies have been set up after 2002.

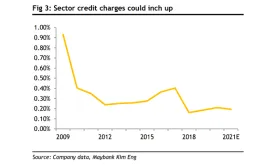

Singapore banks' credit costs to rise 5bp in 2020

The IFRS9 will require banks to set aside for anticipated losses.

Vietnamese banks urged to stem rapid lending

The loan growth of commercial banks hit 17-18% on average.

Chinese banks urged to ramp up lending to rural businesses

Outstanding loans to rural areas already hit $4.91t in 2018.

IDBI Bank puts up $1.4b of bad loans for sale

It holds the unenviable distinction as the bank with the worst-bad loan ratio.

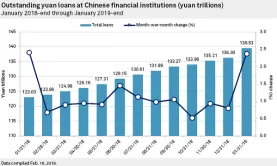

Chinese banks' record-high lending boost only short-term gains

Short-term loans surged 57.8% in January whilst mid- and long-term loans only rose 5.3%.

Central Bank of India puts up $468m worth of bad loans for sale

Interested parties should submit an EOI and sign non-disclosure agreements for an e-auction on 20 March.

Philippine banks' loan growth cools down to 15.7% in January

Household loan growth slowed to 12.7% in January from 13.6% the previous month.

Advertise

Advertise

Commentary

Fighting fraud in the digital banking age

Asian banking’s next frontier: Beyond growth, embracing precision

Rethinking cybersecurity: How APAC banks can safeguard against AI-powered threats